Defining user journeys to improve content discovery

Role: Product Design, UX Research

Outcome: Defined consumer user journeys to redesign Everfi Achieve’s content model, enabling more relevant discovery of 150+ financial education modules.

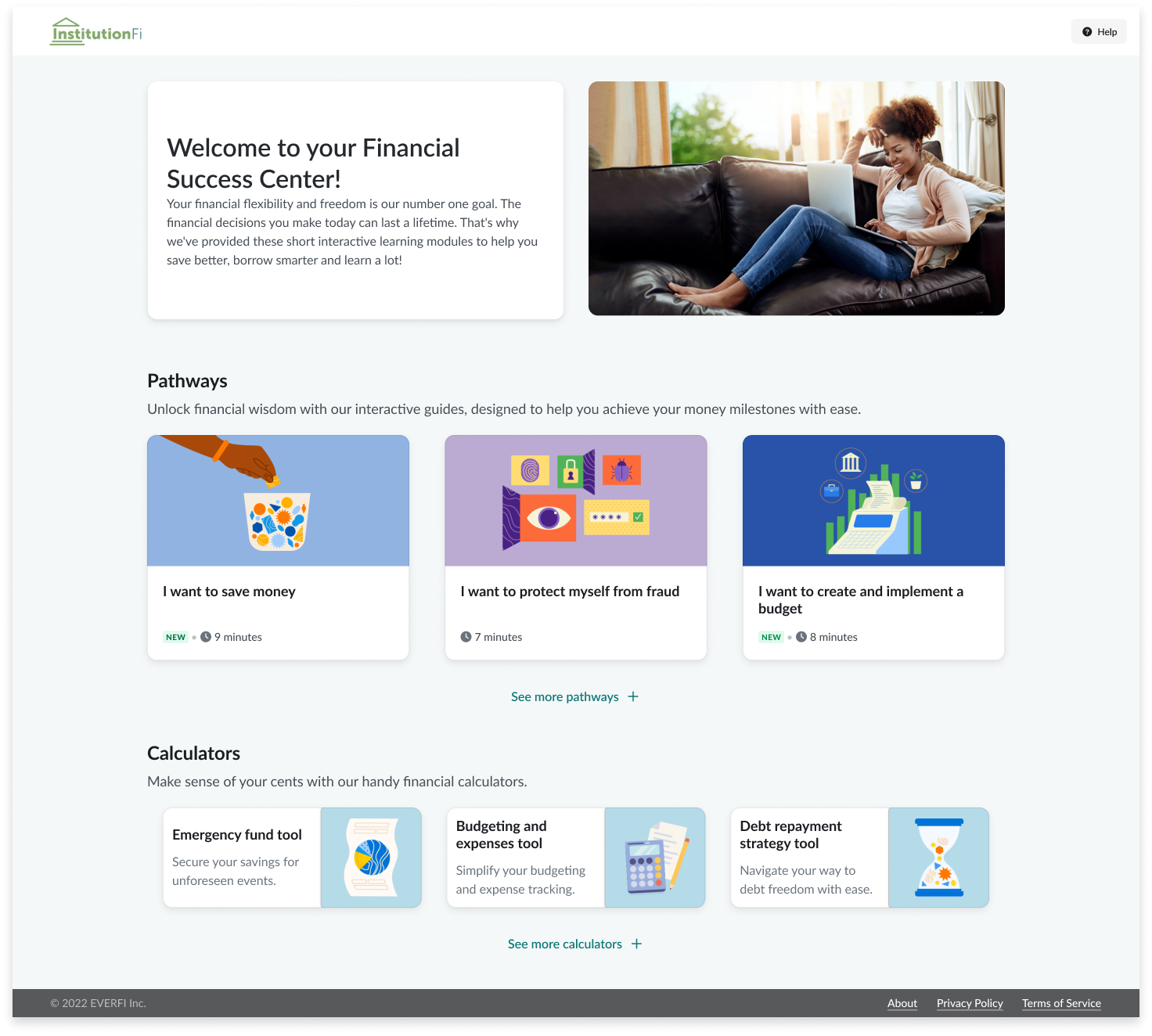

New product content experience

Context

Everfi Achieve is used by over 900 financial institutions and reaches 1.6 million adult learners every year. The product has been in the market for 5 years as a consumer and employee financial wellness course and learning center and consists of nearly 150 content modules on various financial topics.

My role was leading research and design to improve content discovery, create more personalized educational experiences, and deliver a better data story around impact and return on investment for Achieve customers.

Research and discovery

In addition to conducting a comprehensive customer insights inventory, I ran 15 interviews with adult consumers to learn about how adults search for and learn new information about financial topics.

In the 1-hour in-depth interview sessions, I uncovered more about a person’s:

financial decision making process

their level of knowledge before financial decision making

their process of information gathering and what types of sources they seek out, including online and in-person

the types of information they used and why

Key insights

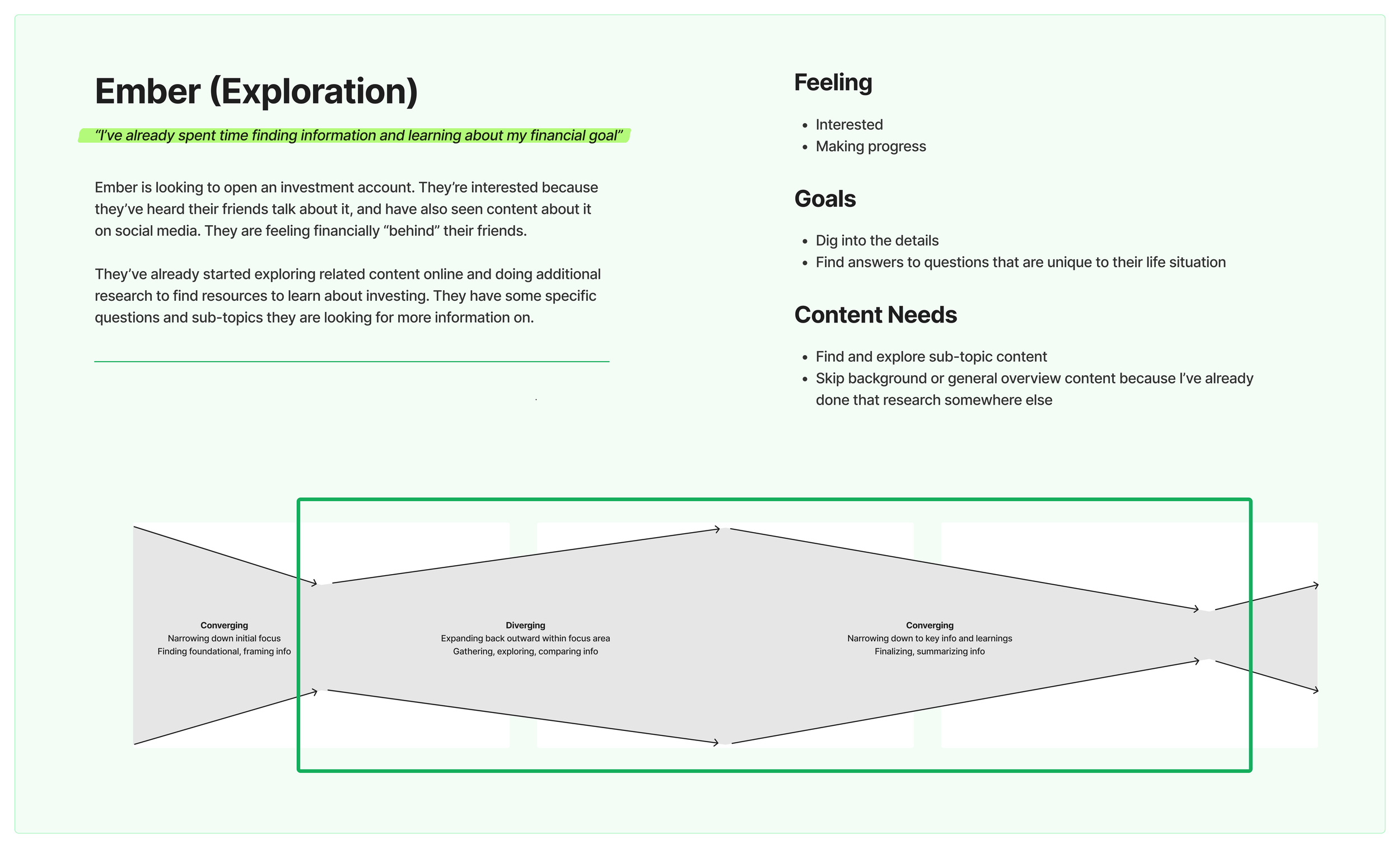

The insights gathered from this research enabled us to have a better understanding of the holistic financial education and information gathering process. I created an adult consumer financial education experience map and three distinct archetypes to communicate these findings with my team which highlighted 3 major stages of the user journey (early, middle, late) and corresponding behaviors, actions, thoughts, information sources, and emotions.

A key part of this artifact for our team was creating a shared understanding of information seeking behavior and how it changes over each stage of the journey, and that it is not a linear process from end to end.

Key insight 1: When people are seeking out financial education, it’s usually because they have to make a financial decision or are facing a specific life event.

Product implications:

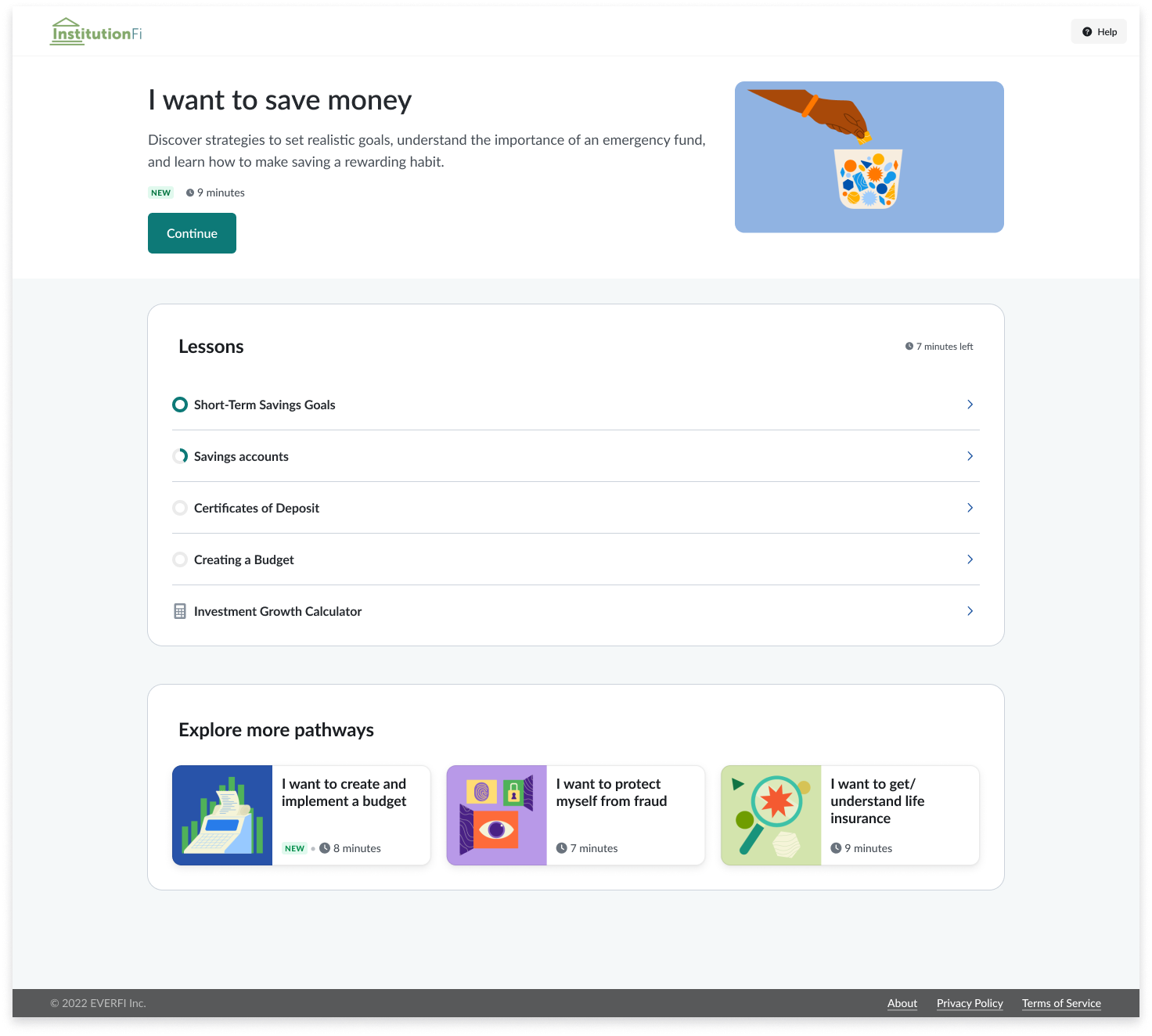

Current product content groups are too vague such as “financial foundations” “building financial capability” and “building financial resilience”

It is not immediately apparent what is inside of these content groups. Modules inside of these larger content groups are not viewable until after clicking “Explore”

Modules within these larger content groups are often mixed in topic area. For example, “checking accounts” “car loans” and “preventing overdraft fees”

Key insight 2: Depending on where people are in the process (early, middle, or late stage), the way they search for information and their learning needs are different.

Product implications:

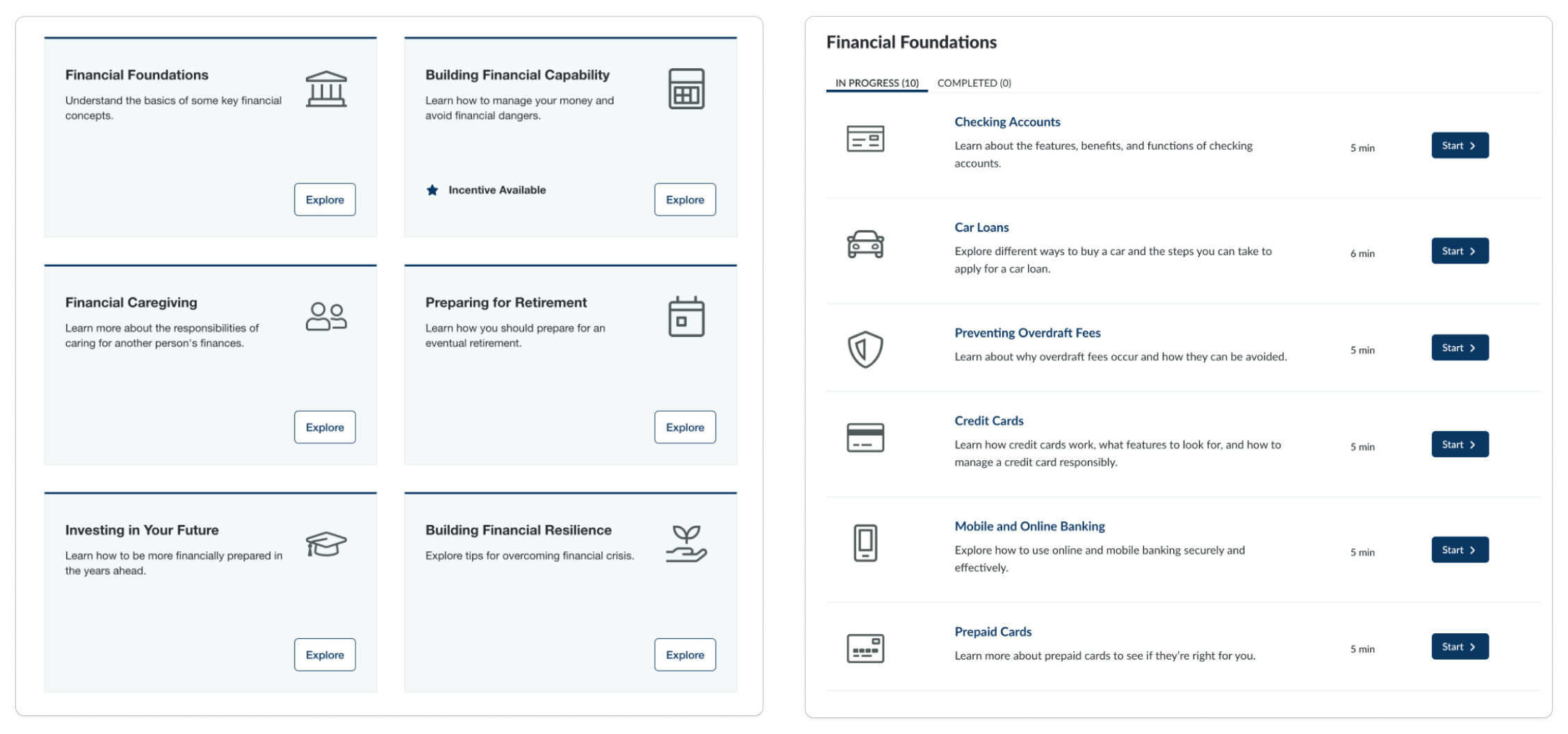

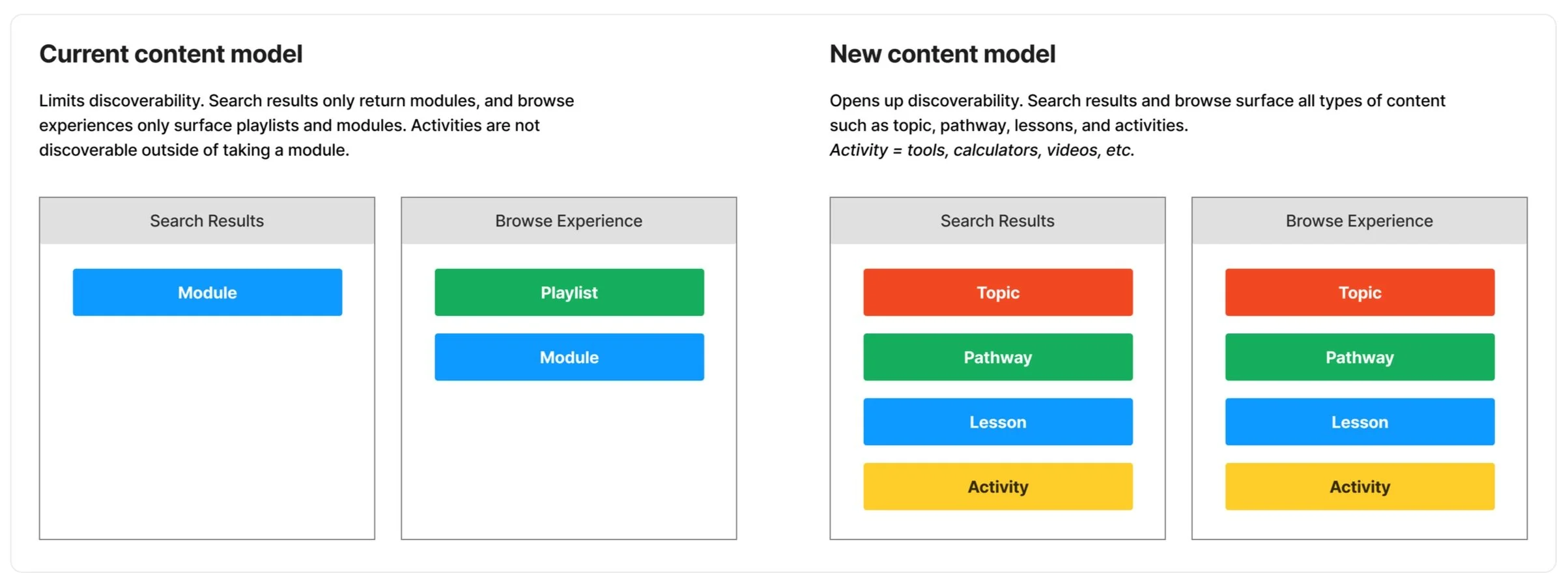

Current content experience only serves the Early stage of the user journey, which is more guided and “stuck together”

People who are in the Middle or Late stage of their journey are often seeking out answers to specific questions or tools, and might want to skip guided and/or overview information

Discrete activities such as tools, calculators, and videos are contained within a module and are not discoverable outside of the module.

Current product content experience

Content model redesign

We completely redesigned our product content model to present financial education in a way that:

Is organized by common financial goals and life events

Meets the needs of any stage of consumer financial education journey

For example, for people early on in their financial education journey we can offer a more structured experience that provides content in a framework format, which in our content model is called a Pathway (formerly called a Playlist). And for people coming into our product who are already well into their financial education journey, we can more easily surface more discrete pieces of content such that allows them to skip foundational information they might already have, which in our content model is called an Activity.

By breaking content apart into smaller pieces, we improved content discovery and relevancy of specific types of content experiences that serve people no matter where they are in their financial education journey,

The user archetypes and artifacts from this design discovery and research directly informed our work in developing new user journey flows, allowing learners to have a targeted experience from their entry point through the entire product, where they can find what they are looking for and discover additional content that aligns with their goals.

This redesign improved our ability to create personalized user experiences within the product, improve content discovery and learner engagement, and led to increased new customer revenue.